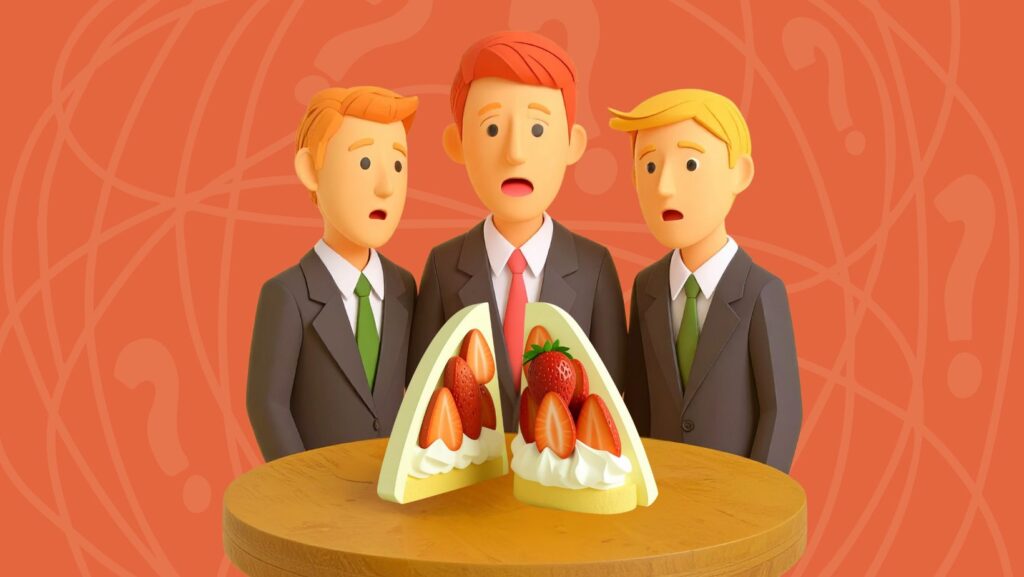

HMRC takes M&S to court over its strawberry sandwich: What small businesses can learn

When it comes to VAT, even the biggest brands aren’t immune from scrutiny. Marks & Spencer (M&S) is currently at the centre of a legal battle with HMRC over the classification – and therefore the VAT treatment – of one of its food items: a strawberry sandwich. It might sound trivial, but the implications reach […]

HMRC takes M&S to court over its strawberry sandwich: What small businesses can learn Read More »