Your tax code tells your employer, or your accountant if you’re running your own business, how much personal allowance to apply to your PAYE tax calculation, and it’s important that it’s correct. In this article we’ll look at what your tax code means, and what you can do if you believe it’s wrong.

The “standard” tax codes

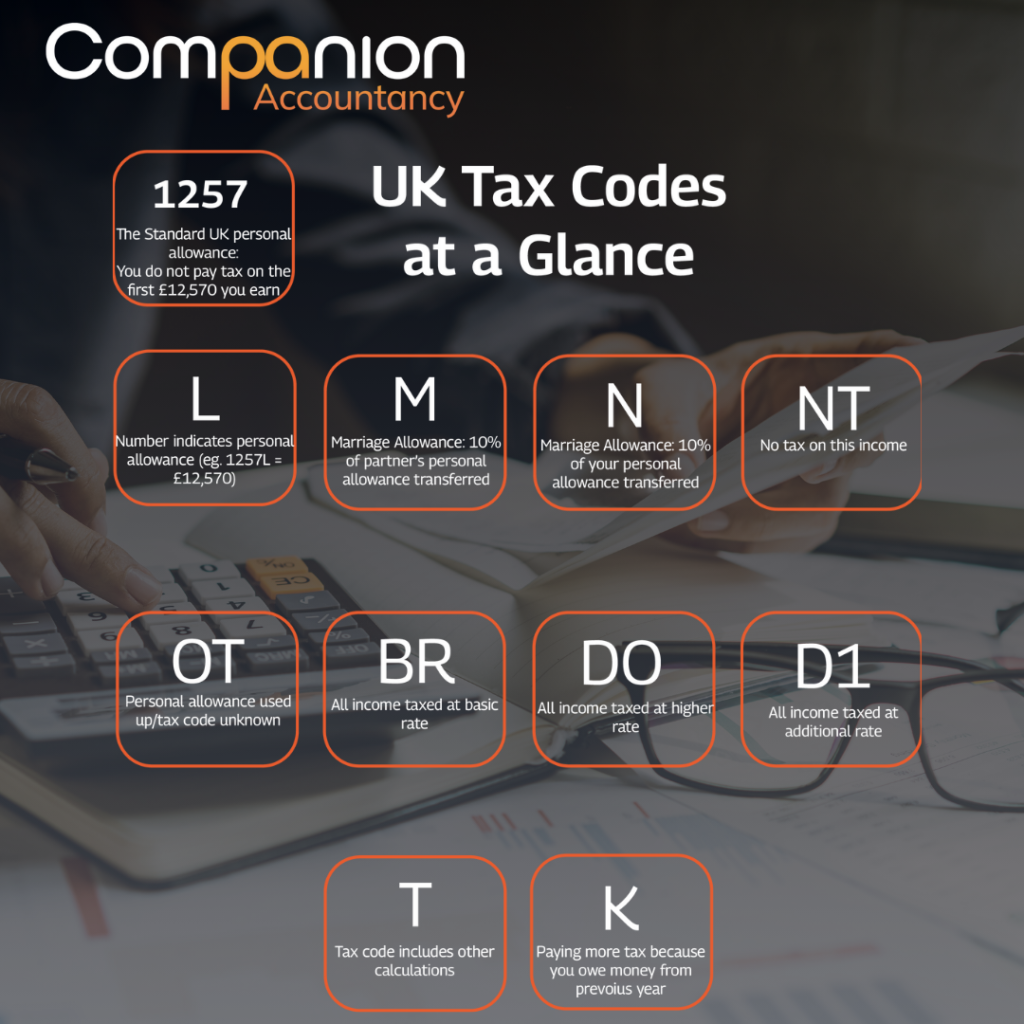

The standard tax code for an only or main job or pension is 1257L (2024/25), which means you have a personal allowance of £12,570. A second job or pension will usually use BR, which means you’ll pay tax at the basic rate on all income from this source, with no personal allowance applied.

Things that might complicate your tax code

These factors might lead to adjustments in your PAYE code:

- Taxable state benefits – estimates may be deducted from your tax-free income

- Benefits in kind – such as company cars or health insurance paid for by your employer

- Underpayments in previous years or other amounts that you owe to HMRC

- If you’re receiving a pension – there may be adjustments for state pension, private pensions or a combination of pension and employment income.

Emergency codes

If your tax code ends in W1, M1 or X (For example, 1257L M1) that means it’s an emergency tax code. This means your tax will be calculated using the figures for this tax period in isolation, rather than the year to date, and it usually indicates that HMRC believe they are missing some information. Their main effect is that your allowance for the year to date is not taken into account, which can result in you overpaying temporarily.

No personal allowance applied

If your entire personal allowance is being applied elsewhere – to another employment or a pension for example – your PAYE code might be BR, meaning you’ll pay basic rate on all this income, DO, meaning all income will be taxed at the higher rate, or D1, meaning the additional rate will be used.

K codes

A tax code with a K at the beginning indicates that you’re paying tax on more income than you actually earn. The most common reasons for this are:

- You’re paying tax you owe from a previous year through your wages or pension.

- You have state benefits or company benefits that you need to pay tax on, and they’re worth more than your personal allowance.

You can’t pay more than half your pre-tax income with a K tax code.

Other codes:

You might also see M or N, where Marriage Allowance is applied, NT where no tax is due on this income, 0T where your tax code is not known or T where other calculations are included.

If you believe your PAYE code is wrong

If you think your tax code is wrong, you can use the check your Income Tax online service to:

- update your employment details

- tell HMRC about a change in income that may have affected your tax code

If this doesn’t resolve the issue, at the time of writing you can contact HMRC directly on 0300 200 3300, between 8am and 6pm Monday to Friday. It will usually help if you have your employer’s PAYE reference to hand.

Once any issues have been resolved, HMRC will issue a new coding notice confirming your change of PAYE code. If applicable, they will also inform your employer.

If you have questions or if we can help in any way, please call our expert team on 01296 468185 or email [email protected].